More and more people of all ages are becoming mobile users worldwide. All industries are evolving and adapting their approaches to the mobile-oriented development trend. FinTech is no exception.

The value of time efficiency and convenience is always increasing. Online banking websites are already not enough. Demanding users want to receive and manage their financial information anytime anywhere. Mobile banking app development is the solution to it.

What is more important, a mobile app is a window for people that belong to the low-income segment. It reduces service costs significantly. ATMs and bank branches consume much more time and money to serve clients while application users resolve most of their issues by themselves. Accessing account balance information, transferring money, checking deposits - all these features are available for the users of modern banking apps. It's fast, it's convenient, it's accessible.

A mobile application is obligatory and a modern standard for any respected bank. Let's find out how to make a mobile banking app efficient.

Secure Operations Are Your Top Priority

A banking application operates with money. Consequently, its safety comes first. Unlike pizza delivery or dating apps, banking app development is all about secure transactions. Nothing matters more than application security in this case.

Highly Experienced Developers Aren't a Waste of Money

Cybercrimes evolve together with security technologies. Every day there are more and more refined schemes of bank fraud. Criminals learn from developed products, so it's up to you to hire highly qualified staff to implement the newest approaches towards encrypting the data and ensuring your banking app safety. Can you save on banking app development cost?

Decent developers aren't a superfluous expense. They are a cost-effective investment. You must understand that a lack of your staff's expertise is fatal. The losses your company will incur as a result of cybercrimes will outweigh any project pricing cuts. Don't forget that finance is what your application works with.

Think Through the Vulnerable Data Storage

App development includes the data storage system. Modern applications store some information on user devices to save the traffic and boost the performance. Keeping some of the vulnerable data on a mobile device is dangerous as it is easy to steal it from there. Keep passwords or any transaction-related information away from unsecured mobile storage.

Consider Multi-Factor Authentication

It's an additional layer of security. Two or more confirmations of the user identity are the evidence of operation authenticity.

For instance, ATMs use the two-factor authentication of a plastic card and a password. They require two things only the user possesses or knows. It makes fraud a much more complicated task as it's significantly harder to get both the card and the password at the same time without being caught. Fortunately, it doesn't bother the customer at all. Multi-factor authentication is a lossless security measure in most cases.

Make Inactive User Sessions Expire

Frauds aim to stay unnoticed. An unsupervised device with the banking account logged in is the perfect victim for criminals. It's similar to leaving your wallet at their disposal.

The solution is clear: close the session with an inactivity timer. Usually, a mobile banking session expires if the user doesn't interact with the application for a few minutes. Make the required inactivity time too short, and it'll confuse the user with an unexpected log out in the middle of the interaction. Make the session too long to expire, and the criminal will gain a chance to take advantage of it. You should run the user experience test and find the best time interval for an inactivity timer that will satisfy both user expectations and security concerns.

Digital Signature Integration

The digital signature technology is similar to the handwritten one. It creates additional data to verify the transaction’s authenticity and to prove the fact of the sender's will to proceed with the transfer of funds. It has a double impact on validation of users’ actions:

- Authentication key. The receiver has a reason to trust the claimed identity of the sender;

- Non-repudiation factor. Honest users won't be affected by it. However, abusive and irresponsible customers often try to abort an unwanted transaction by claiming that they didn't initiate it. A digital signature confirms the identity of the sender, which makes every operation via your banking app verified.

Prevent the Application from Running on Jailbroken Devices

All security measures mean almost nothing if you install the banking app on a hacked device. A jailbroken smartphone manipulates the data your application displays and sends. It can affect general device services as well. Getting access to the SMS functionality (which you can use as a two-factor authentication method) creates a serious security breach and poses a threat to online banking safety. Make sure to check user devices, notify customers about issues and block vulnerable operations in the app in case of a device jailbreak.

Provide Users with an Online Banking Security Manual

Users tend to make mistakes. Here are their most common missteps:

- Data exposure. Users don't always know which information they mustn’t share;

- Running an app on a hacked device. As described above, it leads to dangerous consequences;

- Downloading a fake app. Every year hundreds of thousands of users install forged products and become victims of cybercriminals;

- Irregular updating. You ensure bug fixing and application safety but the users don't update it in time.

You've got to eliminate the lack of valuable knowledge once and for all. Develop a guide on appropriate and safe software use. Describe the main principles of how to make transactions secure, tell the customers where they can find the authentic mobile application and how crucial it is to update the software regularly. You can place the manual on the main online platform to ascertain the customers’ security.

Create a Pleasant User Experience

When all means of security are ready, it's time to move on to the interface part. We can hardly deny the vital importance of rational mobile application design. The notepad-style software isn't valid. At the same time, you can't justify an excessively entertaining interface either. Consider the following points when designing a mobile banking application.

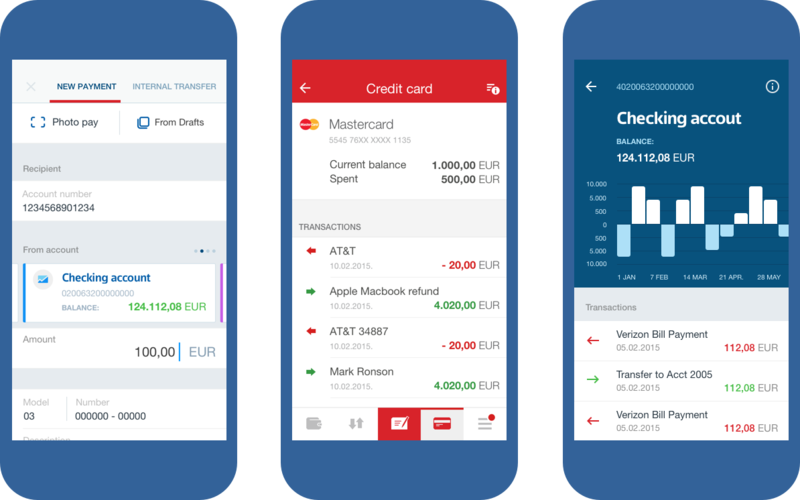

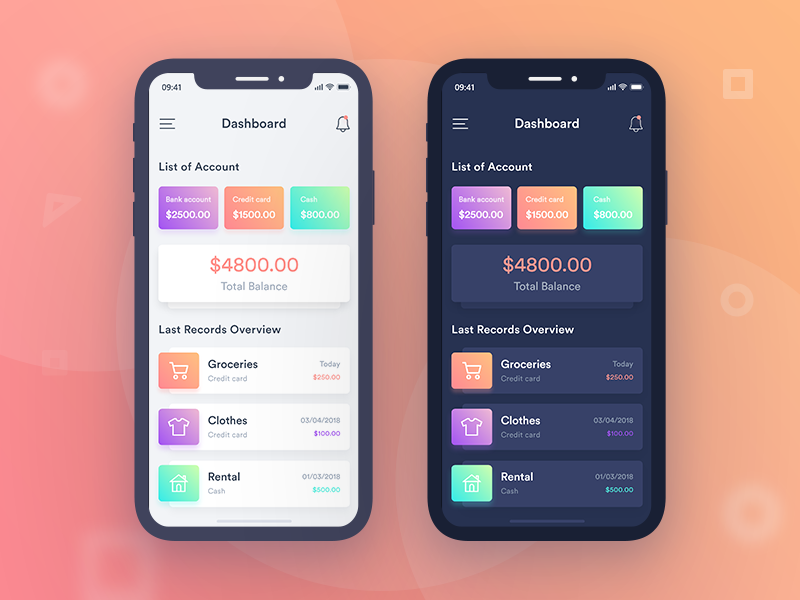

Create Ergonomic Design According to the Corporate Style

Mobile applications for banks are business software, so minimalistic design is a perfect choice for them. Use the corporate colors, fonts, and icons your brand book describes. This creates a highly appreciated holistic experience when customers feel on the same page with both the website and mobile app.

It's also essential to synchronize the data between platforms to avoid confusion and misunderstandings.

Implement the Best Mobile UI/UX Practices

Mobile application design differs from web development. An entirely different platform makes you adjust the design principles. Whether you are developing software for Android or iOS, adhere to the provided guidelines for these platforms. Keep in mind that the screen size is different in every single case. Make your design perform stably on various screens. Remember about the Thumb zone.

Build a Light And Fast Application

User attention span is rapidly decreasing. The acceptable response time is a few seconds long nowadays. How can you achieve what you need to within this time?

You've already implemented the minimalistic design. Now it's time to cut the traffic consumption by minimizing the functionality. The point is that a mobile app isn't the same as the website. You are trying to meet new user expectations. Almost all of your mobile users basically need to do 4 things:

- Check account balance;

- Make a quick transaction;

- Deposit a check;

- Be able to contact customer service.

That's it! Nevertheless, every single case is unique, and your customer can also be in desperate need of additional banking app functionality.

The point is you should include as little “functional weight” in the application as possible. If it's necessary to have an enormous number of features, consider putting them in separate software products to enhance their performance separately from each other.

Interact With the User

We love to be in charge of the situation, and so do users. Guide them through your banking app, notify them about every operation, let them know if there is a change in their account.

It's vital to create an opportunity for clients to leave feedback or to get immediate support. Build a feedback form and place all of your contacts to resolve any issue promptly.

Collect Helpful User Data and Optimize Your Application

Monitor the key app metrics and the overall performance figures. Find drawbacks to your design and eliminate them in time. Do customers use the second menu option ten times more frequently than the first one? Maybe it's time to swap them. Have you traced notably slow performance of one of the app screens? Something might be wrong. Make sure to check and fix it. Regular design updates and bug fixes are nothing but are the reason clients will use your application regularly over and over again.

The Bottom Line

As you can see, all the issues regarding how to develop a mobile banking app boil down to providing secure operations and an ergonomic corporate interface. Implement these two aspects properly, and you will create a decent mobile banking application. If you have any questions about app development for banks, don't hesitate to contact us.